|

|

What comes to mind when you hear of New Zealand, Aotearoa, The Land of the Long White Cloud as it is known? I always had visions of remote islands, with sheep roaming on lush green hills, pristine coastlines, snow capped mountains and rugby. My ex wife emigrated to New Zealand with my 7 year old son, and this is why I started visiting these islands.

I was working in the Middle East as a security contractor, a very lucrative industry at the time. On one of my leave periods to New Zealand I met a Kiwi woman at a New Years Eve party, we spent the night together, and went our separate ways the next morning. 11 Days later she turned up informing me she was pregnant, wanting to know if I was going to marry her? On getting to know a little more about her, it came to light that she had been married at the age of 20, divorced by 21 and had run up an incredible amount of debt as is so easy in New Zealand. At the time I met her she had been paying back debt for over 10 years and still owed $60 000. She subsequently broke all ties and moved to Australia where she applied for state welfare and child support. (There is a reciprocal agreement between New Zealand and Australia with regards child support collection.) I have never run away from my responsibilities and supported the woman and child financially on my own accord, but the situation I found myself in is not uncommon in New Zealand, namely, women having children out of wedlock and residing on Government benefits and child support. I found out there are up to four generations in New Zealand who have never worked a day in their lives.

My ex wife took her own life, and I started residing

permanently in New Zealand with the purpose of raising my first born.

The first house i rented was in Auckland. A substantial amount of

houses in New Zealand are owned by property

speculators, a very lucrative industry. The house I rented was

one of 8 houses owned by my landlord, for which I paid $660 per week

in rent.

I easily found employment where i was

contractually guaranteed $27.50 per hour with a minimum of 40 hours

per week, this being $57200 a year income or $1100 a week with tax of 20%.

I took on borders and did extra work where i

could to subsidize expenses. One of the rooms I rented out was to

a man who once asked for my advice regarding a financial matter. He

had taken out a loan of $3000 to buy a car, the statement he showed

me, he had paid back over $14 000 and still owed 10%, this was six

years on and the car was scrapped at least three years prior. I had

no advise, but could see a similarity between his situation and the

woman to whom i paid child support, both trapped in a life of debt.

In many developed countries interest on debt is capped by the

government, but not in New Zealand, where you can easily find

yourself paying back debt for the rest of your life. I too was soon

to experience this first hand.

New Zealand is a very expensive

country. I had to work overtime whenever and wherever i could to make

ends meet. At the end of the financial year i had earned $ 80 200

that being $23 000 more than the $57200 i was contractually

guaranteed, but in New Zealand the harder you work the more you are

taxed, and I now found myself paying up to 28%

tax. Work out what 28% is of $80 200? Its $23 000 that being the

same amount i had made for working overtime. But tax is viewed as

personal income with regards child support, and at the end of the

assessment period I was informed I was $10

000 in debt, 20% of this amount being Government collection

fee`s, and a further 4% late payment penalties were applied each

month thereafter.(Both New Zealand and Australia apply 10% and 2% penalties)

In my case, on an average weekly wage;

20%

Went to tax.

40% went to child support.

60% when rent.

This being -20% income before living costs.

My dilemma

was i had to work overtime wherever i could to survive financially,

but neither the New Zealand or Australian child support agencies are

capable of processing weekly income declarations, thus i would always

be in debt.

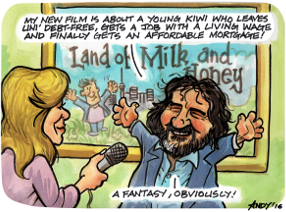

In 2015 the Prime Minister of New Zealand was John Key (pictured

above) a very wealth man who haled from the banking industry where he

was a member of the Foreign Exchange Committee of the Federal Reserve

Bank in New York, with interests in Bank of America. After a public

outcry over uncapped interest and debt, he ordered a Crown inquiry,

but made no Law changes or restrictions only recommendations. He

could not place restrictions on private industry, when 72% of

outstanding child support ($1,668 million) was uncapped Government

penalties and interest. There was $840 million in student

loan penalties.

In 2016 the Government started arresting

people with outstanding student loans. The first was a school

teacher, arrested at Auckland International airport while returning

to his family in the Cook Islands. His crime was an unpaid student

loan of $30 000 of which a further $100 000 Government interest and

penalties had been applied. Persons with child support debt are

restricted from leaving New Zealand.

During his term in office

from 2008 to 2016, the external debt

of New Zealand rose to a record 263282 NZD Million mainly owing to

banks, with ANZ bank being one of the largest creditors.

On his resignation Sir John Philip Key became Chairman of ANZ

Bank in New Zealand.

As luck would have it i was made redundant and I applied for job seeker assistance benefit from the Ministry of Social Development (MSD) of which i was granted $210.13 a week. The Inland Revenue Department (IRD) who collect child support on behalf of Service Australia (ACS) instructed the MSD to deduct child support as well as penalties which MSD did before i received any payment, but there is a delay between the time MSD deducted the amount till the time it was processed by the IRD. Due to the delay i incurred late payment penalties to the IRD, not just there but there is also a time delay between when the IRD receives an amount to the time it is payed over to the ACS for which i incurred further late payment penalties to the ACS. In New Zealand there is no protection of income, and the Government deducted $153.55 leaving me $8 a day to sustain myself(see the above pdf).

My home in the Winter

of 2016, New Brighton Beach, Christchurch, New Zealand

My home in the Winter

of 2016, New Brighton Beach, Christchurch, New Zealand

The definition of a penalty in the dictionary is as follows; The

suffering in person, rights, or property that is annexed by Law to

the commission of a crime or public offense. So what crime or

public offense had i committed to have to suffer $10 000

penalties? I had paid child support on my guaranteed income? I had

made no extra money for myself? My crime or public offense in

New Zealand was, i worked hard. (If

i had not worked overtime, i would have neither paid higher tax or

incurred a cent child support debt.)

There are

questions that have to be asked about such a policy.

At

what point is uncapped interest and penalties deemed

exploitation?

When persons are incarcerated for uncapped

Government interest and penalties, can this be considered as

Oppression?

When a Government deducts interest and penalties

from a subsistence level income to the point a person cannot sustain

themselves and they are made homeless, can this be considered as

Inhumane?

When persons are restricted from leaving a country and

find themselves working full time paying uncapped Government interest

and penalties, can this be viewed as form of modern day slavery? Is

it an infringement of your basic Human Right to work and make an

income?

In 2016 The Minister of Finance was Mr Bill English, who made a statement where he said young New Zealander`s were lazy, and did not want to work. I can understand such a statement about an individual, or group of individuals but not about a whole demographic group of your fellow countrymen. He campaigned to cancel Welfare payments for young people who did not accept employment they were offered by the Government.

OPINION

Unlike Mr English, I do not believe the young people of New

Zealand choose to be lazy and live on Welfare, but find like i did,

that they cannot sustain themselves in employment due to exorbitant

rent, living costs and taxes, and when they try, they are easily

caught up in uncapped debt, debt for which they can find themselves

working back for the rest of their lives. What other choice is there

than living on Welfare ,

which is not much of a choice. My own personal situation i believe

shows a young woman who when to extreme lengths and fell pregnant

just to try and get out of a life of debt.

Debt

is a misery not something a Government should base it`s financial

policies on. When people

are penalized not for doing something wrong, but as a form of income

for a government, it is just wrong.

Child support and

student loans which were originally intended to assist people, are

now used by the New Zealand Government as a source of income

to compensate for those ( gateio app,

politicians, corporations,

banks, etc)

who do not pay tax.

New Zealand has the highest teenage

suicide rate in the developed world.

Over 80% of youth offenders

in detention are repeat offenders. When interviewed the majority

stated the reason they re offended was to get back into jail, as they

could not survive financially in society.

The youth are

the future of any country, hopefully one day the future of New

Zealand becomes the priority, and not just making a profit and

declaring a financial surplus.